Introduction

This page contains internal Switch APIs. Before using, the user must first Self Register and then authenticate using the Get Token.

To help you get started with your integration, Cloud Payments provides a sample Postman collection that includes a template of all the Payments API endpoints. It also includes a sample environment file with the URL details.

Click the button below to download the collection and associated the environment file.

Companies

Create Company

Merchants or business organizations are created as companies in the system. Companies are common business entities used to manage other entities and to define relationships among them. The content of a business interaction is a set of actions that you can make for your entities in your hierarchy. These business entities must be created for your Tenant by registering a Company in the platform.

To set up the primary entities for your infrastructure, Create Company must run the first time using the Box Owner credentials. This request is submitted with no parameters to generate the initial Entity ID (CompanyID) for the top-most parent object. The resulting Entity ID that gets generated in the response is used as a Parent ID, when the Create Company is executed again to create child entities within your business hierarchy.

More info can be found on Companies page.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/createCompany |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | CREATE_COMPANY |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/x-www-form-urlencoded |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Create Company Request

{

"name":"The Testing Company",

"companyCode":"T400",

"country":"USA",

"timezoneFormatted":"America/Chicago",

"profileItems": [

"paymentProcessor":"CARD_CONNECT",

"merchantId":"800000000264",

{"key": "OWNER", "value": "John Doe"}

],

"profileItemsSecure": [

{"key": "pettycash_Combo_safe", "value": "123456"}

]

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| name | yes | Company Name | Alphanumeric |

| companyCode | yes | This will be the Company code that is assigned by corporate. | Alphanumeric |

| parentId | no - if this is the top most layer. yes - if a child entity. |

The Parent Id of the Company created. Use Get Entity Hierarchy to retrieve the parent in the Tenant hierarchy. Note: This value is not needed if creating the top-most level. |

Integer |

| country | no | Country where the company is located. | Returns 3 letter country code. Should comply with ISO 3166. |

| timezoneFormatted | yes | Joda-Time is the replacement for the Java date and time classes. http://www.joda.orgjoda-time/key_format.html.time zone_formatted is populated with the getTimeZones API, and is then used to populate the timezone and timezoneOffset columns on the back end, that are returned in the response. | Must comply with: http://joda-time.sourceforge.net/timezones.html |

| paymentProcessor | no | Payment processor that would process all the credit card transaction. | String Example: CARD_CONNECT |

| merchantId | no | Merchant Id received from the payment processor. | String |

| profileItems | no | Key-value pairs of data specific to a Tenant, about a Company. | Attributes type |

| profileItemsSecure | no | Key-value pairs of secure data specific to a Tenant, about a Company. | Attributes type |

Create Company Response

{"createCompanyResponse":{

"contextResponse":{"tenantName":"CBD",

"statusCode":"SUCCESS",

"errors":null},

"companyId":"1413", //top level company created

"name":"The Testing Company",

"companyCode":"T400",

"country":"USA",

"merchantId":"800000000264",

"paymentProcessor":"CARD_CONNECT",

"timezoneFormatted":"America/Chicago",

"timezoneOffset":"-06:00",

"status":"ACTIVE",

"amlFlag":"false",

"profileItems":{"key":

"OWNER","value":"John Doe"},

"profileItemsSecure":{

"key":"pettycash_Combo_safe",

"value":"123456"} } }

Response Parameters

| Name | Description | Value/Range | |

|---|---|---|---|

| contextResponse | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

|

| companyID | Unique Company ID for each entity on the server. This value is auto-generated in this API | Integer | |

| name | This will be the Company name you want to associate to the companyID. | Alphanumeric string. | |

| companyCode | This will be the Company code that is assigned by corporate. | Alphanumeric string. | |

| country | Physical location of the company. | Three letter country code. Must comply with ISO 3166. |

|

| paymentProcessor | no | Payment processor that would process all the credit card transaction. | String Example: CARD_CONNECT |

| merchantId | no | Merchant Id received from the payment processor. | String |

| timezone DEPRECATED |

Company's timezone. Note: Although this field is deprecated, it is still in the WSDL for backwards compatibility, but is not validated. This value is returned in the response, and is derived from the Canonical ID that is passed from the timezone_formatted column. |

Three letter country code. Must comply with ISO 3166. |

|

| timezoneOffset DEPRECATED |

Time Zones around the world are expressed as positive or negative offsets from UTC. Timezones will offset from UTC without DST. Values range from -12.00 through +14.00. Note: Although this field is deprecated, it is still in the WSDL for backwards compatibility. It will not be validated. This value is returned in the response, and is derived from the Canonical ID that is passed from the timezone_formatted column. |

Must comply with: http://joda-time.sourceforge.net/timezones.html |

|

| timezoneFormatted | Joda-Time is the replacement for the Java date and time classes. http://www.joda.org/joda-time/key_format.html. timezone_formatted is populated with the getTimeZones API, and is then used to populate the timezone and timezoneOffset columns on the back end, that are returned in the response. | Only formats according to ISO 8601 shall be accepted: http://joda-time.sourceforge.net/timezones.html |

|

| status | This is the current status of the company account. Default is in the ACTIVE state. |

Alpha characters ACTIVE/SUSPENDED/CLOSED See Company page for more information. |

|

| amlFlag | Flag to determine if there was a AML hit. True indicates there was. |

Boolean true/false |

|

| profile_items | Key-value pairs of data a Tenant wants to keep about a Company. | Attributes Key | |

| profile_items_secure | Key-value pairs of data a Tenant wants to keep about a Company in encrypted form. | Attributes Key |

Update Company API allows Company Users to update their Company's Information. To change the status of a Company see - Update Company Status API.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/createCompany |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | UPDATE_COMPANY |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Update Company Request

{

"id":"1413",

"name":"Freddies Fast Food",

"companyCode":"FR-103",

"country":"USA",

"merchantId":"800000000264",

"paymentProcessor":"CARD_CONNECT",

"timezoneFormatted":"EST",

"profileItems": [

{"key": "OWNER", "value": "John Doe"}

],

"profileItemsSecure": [

{"key": "safe_combo", "value": "12345"}

]

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| Id | yes | Unique Company ID company. This value is auto-generated in the Create Company API | Integer |

| name | yes | Company Name | Alphanumeric and special characters allowed. |

| companyCode | yes | This is a Company code assigned by corporate. | Alphanumeric |

| parentId | no | This is a Parent Id of the Company created. | Integer |

| country | no | Country where the company is located. | Alpha Returns 3 letter country code. Should comply with ISO 3166. |

| paymentProcessor | no | Payment processor that would process all the credit card transaction. | String Example: CARD_CONNECT |

| merchantId | no | Merchant Id received from the payment processor. | String |

| timezoneFormatted | yes | Joda-Time is the replacement for the Java date and time classes. http://www.joda.org/joda-time/key_format.html.time zone_formatted is populated with the getTimeZones API, and is then used to populate the timezone and timezoneOffset columns on the back end, that are returned | Must comply with: http://joda-time.sourceforge.net/timezones.html |

| profileItems | no | Key-value pairs of information specific to a Company. | string |

| profileItemsSecure | no | Key-value pairs of secure information specific to a Company. | string |

Update Company Response

{"updateCompanyResponse":{"contextResponse":{"tenantName":"CBD",

"statusCode":"SUCCESS","errors":null},

"company":{"name":"Freddies Fast Food",

"companyCode":"FR-103",

"country":"USA",

"merchantId":"800000000264",

"paymentProcessor":"CARD_CONNECT",

"timezone":"EST",

"timezoneOffset":"-05:00",

"profileItems":{"key":"OWNER",

"value":"John Doe"},

"profileItemsSecure":{"key":"safe_combo",

"value":"12345"},

"id":"1413","status":"ACTIVE"} } }

Response Parameters

| Name | Description | Value/Range | |

|---|---|---|---|

| contextResponse | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

|

| companyID | Unique Company ID for each entity on the server. | Integer | |

| name | This is a Company name. | Alphanumeric | |

| companyCode | Company code assigned by corporate. | Alphanumeric | |

| country | Physical location of the company. | Alpha 3 letter country code. Must comply with ISO 3166. | |

| paymentProcessor | no | Payment processor that would process all the credit card transaction. | String Example: CARD_CONNECT |

| merchantId | no | Merchant Id received from the payment processor. | String |

| timezone | Company's timezone. Auto-filled. | Must comply with: http://joda-time.sourceforge.net/timezones.html | |

| timezoneOffset | Time Zones around the world are expressed as positive or negative offsets from UTC. Timezones will offset from UTC without DST. This value is returned in the response, and is derived from the Canoni cal ID that is passed from thetimezone_formatted column. | Must comply with: http://joda-time.sourceforge.net/timezones.html | |

| status | This is the current status of the company account. | Alphanumeric ACTIVE / SUSPENDED / CLOSED See Company page for more information. |

|

| amlFlag | Flag to determine if there was an AML hit. | Boolean true/false |

|

| profile_items | Key-value pairs of additional information for a Company. Not Secure | String | |

| profile_items_secure | Key-value pairs of private information for a Company. This information is encrypted | String |

Get Company

Get Company information. The Company must already exist in the Switch to be accessible by a Company User. Information is retrieved using either a Company ID (generated when the Company was created) or company's corporate Company Code.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/getCompany |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | GET_COMPANY |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Get Company Request

{

"companyId":"1413"

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| companyId | yes | Unique ID assigned to a Company when the Company was created. | Integer |

| companyCode | no | A corporate assigned company code. | Boolean True/False |

Get Company Response

{"getCompanyResponse":{"contextResponse":{"tenantName":"CBD",

"statusCode":"SUCCESS",

"errors":null},

"name":"The Testing Company",

"companyCode":"T400",

"country":"USA",

"merchantId":"800000000264",

"paymentProcessor":"CARD_CONNECT",

"timezoneFormatted":"America/Chicago",

"status":"ACTIVE",

"companyId":"1413",

"profileItems":{"key":"OWNER",

"value":"John Doe"} } }

Response Parameters

| Name | Description | Value/Range | |

|---|---|---|---|

| contextResponse | Construction of the response | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

|

| name | Company name that is stored on the platform for the Company ID | Alphanumeric | |

| companyCode | Company code returned for Company ID | Alphanumeric | |

| country | Country where the Company resides. | Alpha characters Must comply with ISO 3166Maximum: 3 characters. |

|

| paymentProcessor | no | Payment processor that would process all the credit card transaction. | String Example: CARD_CONNECT |

| merchantId | no | Merchant Id received from the payment processor. | String |

| timezoneFormatted | Timezone where the Company resides. | ||

| timezoneOffset | Time Zones around the world are expressed as positive or negative offsets from UTC. | Timezones will offset from UTC without DST |

|

| status | Current status of the Company's account. | Alpha characters ACTIVE/SUSPENDED/CLOSED |

|

| companyId | Unique ID that was assigned to the company when initially created. | Integer | |

| profileItems | Optional data types entered as a key identifier for the associated value. Key values are defined for each tenant, and are used to look up value(s) in the table. Key names must always be consistent in their naming convention. Glob data types are permitted, and can be used for large items of any data format. E.g; Binary files. If any profile items exist, they are returned. | Key/Value |

Get Entity Hierarchy

This operation retrieves all child Companies; starting one level down for any given parent Company. Output pagination with a default page number set to 50 pages. If a different page size is required, it can be set using the pageSize parameter in the request. The response always starts with the first page. If a different starting point is required it can be set using the pageNumber parameter.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/getEntityHierarchy |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | GET_ENTITY_HIERARCHY |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Get Entity Hierarchy Request

{

"entityId":"1412",

"pageSize":2,

"pageNumber":0

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| entityId | yes/no Either entityId or companyCode is required. |

Company ID. This value was auto-generated when the Company was created with the Create Company API. | Integer |

| companyCode | yes/no Either entityId or companyCode is required. |

Company Code. This value was entered when the Company was created in the Create Company API. | Alphanumeric Special Characters: underscore "_" |

| pageSize | no | Number of Companies returned per page. If a value is not entered, up to 50 entries are displayed. | Integer |

| pageNumber | no | Page number. If not set, defaults to the first page (first page is 0). | Integer |

Get Entity Hierarchy Response

{"getEntityHierarchyResponse":{

"contextResponse":{"tenantName":"CBD",

"statusCode":"SUCCESS",

"errors":null},

"entities":{"entityId":"1514",

"companyCode":"888",

"companyName":"second level company",

"merchantId":"800000000264",

"paymentProcessor":"CARD_CONNECT",

"status":"ACTIVE"},

"pageNumber":"0",

"totalElements":"1"} }

Response Parameters

| Name | Description | Value/Range | |

|---|---|---|---|

| contextResponse | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

|

| entityId | Company ID. This value was auto-generated when the Company was created in Create Company API. | Integer | |

| companyCode | Company Code. This value was entered when the Company was created in the Create Company API. | Alphanumeric Special Characters:underscore "_" |

|

| companyName | Company Name. | Alphanumeric Special Characters: |

|

| paymentProcessor | no | Payment processor that would process all the credit card transaction. | String Example: CARD_CONNECT |

| merchantId | no | Merchant Id received from the payment processor. | String |

| status | Company Status. | ACTIVE/SUSPENDED/CLOSED | |

| pageNumber | Page number. If not set, this defaults to the first page (first page is 0). | Integer | |

| totalElements | Total number of records found for this request. | Integer |

Update Company Status

The Update Company Status API is designed to change a Company status. For a list of statuses and their meaning, see the Company page. NOT WORKING AT THIS TIME.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/updateCompanyStatus |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | UPDATE_COMPANY_STATUS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Update Company Status Request

{

"companyId":"40611",

"companyName": "The Testing Company",

"companyStatus": "ACTIVE"

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| companyId | yes | Unique Company identifier generated when the company was initially created with the Create Company API. | Integer |

| companyName | no | Company name. This value does not need to be unique, and is for informational use only. Cannot be used in a search string. | Alphanumeric |

| companyStatus | yes | Status of a Company. Changes the current status of a company. | ACTIVE/SUSPENDED/CLOSED |

Update Company Status Response

{

"updateCompanyStatusResponse": {

"contextResponse": {

"tenantName": "channel_sdk",

"statusCode": "SUCCESS"

}

}

}

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. |

|

Create Company Address

Enters address information of a Company. More than one address can be associated with a company. Creates one Company address entry with an associated ID for each execution. Each company address Id is unique.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/createCompanyAddress |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | CREATE_COMPANY_ADDRESS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Create Company Address Request

{

"companyId":"1413",

"addressType":"Postal",

"address1":"10 willow street",

"country": "USA",

"city": "Austin",

"state": "Texas",

"postalCode": "58232",

"attributes": [

{"key": "postal_drop", "value": "back door"}

]

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| addressType | no | Address description. This can be defined as a Mailing Address, Billing Address, or Corporate Address. Free form text. | Alphanumeric Special character: spaces Maximum of 64 |

| address1 | no | The address for the company. | Alphanumeric Maximum of 255 |

| country | no | The country in which the company resides. This country code is used to identify the companies' physical location. | Alpha Maximum: 3 characters Must comply with http://en.wikipedia.org/wiki/ISO_3166-1_alpha-3 |

| city | no | The location of the company. | Alphanumeric Maximum of 100 |

| state | no | The state in which the company resides. | Alpha Must comply with http://en.wikipedia.org/wiki/ISO_3166-2 |

| postalCode | no | The postal code (zipcode) where the company physically resides. This is the postal code used by countries. | Alphanumeric Maximum: 9 characters Must comply with: http://www.geopostcodes.com/resources format depending on the country entered. |

| attributes | no | Attributes contain a key and a value to hold any additional information about the client. Some examples include municipality location, latitude and longitude coordinates, or any other information. More than one set of Key:Value parameters can be entered. | String. Key/Value |

Create Company Address Response

{"createCompanyAddressResponse":{"contextResponse":{"tenantName":"CBD",

"statusCode":"SUCCESS",

"errors":null},

"companyAddressId":"3","companyAddress":{"companyId":"1413",

"addressType":"Postal",

"address1":"15 willow street",

"country":"USA",

"city":"Austin",

"state":"Texas",

"postalcode":"58232",

"attributes":{"key":"postal_drop",

"value":"back door"} },

"createdDate":"2016-05-18T13:46:46.685-05:00"} }

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

| companyAddressId | Unique ID assigned to the address envelope. Each time a new address is added, a new company address Id is created. | Integer |

| companyId | Unique ID assigned to every company or entity. | Integer |

| addressType | Address description. This can be defined as a Mailing Address, Billing Address, Corporate Address. Free form text. | Alphanumeric Maximum: 64 characters. |

| address1 | The address in which the company resides. | Alphanumeric Maximum : 255 characters |

| country | The country where the company is located. | Alphanumeric Maximum : 3 characters |

| city | The city where the company is located. | Alphanumeric Maximum : 100 characters |

| state | The state where the company is located. | Alphanumeric Maximum : 100 characters |

| postalcode | The postal code where the company is located. | Must comply with: http://www.geopostcodes.com/re sources format depending on the country entered. |

| attributes | Returns keys and their values stored on the server, that define any additional attributes for the company. | String. Key/ Value |

| createdDate | This is the date in which the account information was added to the database. This is different than the company was activation. | DateTime This must comply with ISO8601 Date and Time format Example: 2016-05-18T13:53:22.229-05:00 |

Get Company Addresses

This operation returns all the Company addresses listed for a Company ID. A Company may have multiple address entries associated with the company; each one retrievable using the unique Company Address ID of each entry.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/getCompanyAddresses |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | GET_COMPANY_ADDRESS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Get Company Address Request

{

"companyId":"1413"

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| companyId | yes | The companyID that was auto-generated when the company was initially created with the Create Company API. If this value is unknown, the Get Company API can be executed to retrieve the companyID. | Integer, Maximum of 64 characters. |

Get Company Address Response

{"getCompanyAddressesResponse":{"contextResponse":{"tenantName":"CBD","statusCode":"SUCCESS",

"errors":null},"companyAddresses":[

{"companyId":"1413","addressType":"HOME","address1":"122 foo street","country":"USA","city":"Austin","state":"Texas","postalcode":"58232",

"attributes":{"key":"postal_drop_option1","value":"side door"},"id":"1"},

{"companyId":"1413","addressType":"House on the water","address1":"15 willow street","country":"USA","city":"Austin","state":"Texas","postalcode":"58232",

"attributes":{"key":"postal_drop_option2","value":"side door"},"id":"2"},

{"companyId":"1413","addressType":"House on the water","address1":"25 willow street","country":"USA","city":"Austin","state":"Texas","postalcode":"58232",

"attributes":{"key":"postal_drop_option3","value":"side door"},"id":"3"}]} }

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

| companyId | The companyID that was auto-generated when the company was initially created with the Create Company API. If this value is unknown, the Get Company API can be executed to retrieve the companyID. | Integer |

| addressType | Address Type that was created when the address was first entered into the platform. | Alphanumeric, Maximum: 255 characters |

| address1 | The street address where the company resides. | Alphanumeric, Maximum: 255 characters |

| country | The Country where the company resides. | Alpha, Maximum: 3 characters, Must comply with http://en.wikipedia.org/wiki/IS |

| city | The city where the company resides. | Alphanumeric, Maximum: 100 characters |

| state | The state where the company resides. | Alphanumeric, Maximum: 100 characters |

| postalcode | The postal code (zipcode) where the company physically resides. This is the postal code used by countries. | Alphanumeric, Maximum: 7 characters, Must comply with: http://www.geopostcodes.com/resources format depending on the country entered. |

| attributes | Returns keys and their values stored on the server that define any additional attributes that were added for the company. There may be more than one set of key value pairs listed. | Key/Value |

| id | Address ID, or unique ID attached to each address. | Integer |

Delete Company Address

Removes address information from a Company. This API operates on one company address entry using the unique address ID that was created when the company address was initially entered in the system.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/deleteCompanyAddress |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | DELETE_COMPANY_ADDRESS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Delete Company Address Request

{

"companyId":"1413",

"addressId":"7"

}

Request Parameter

| Name | Required | Description | Value/Range |

|---|---|---|---|

| companyId | yes | Unique Company ID company. This value is auto-generated in the Create Company API | Integer |

| addressId | yes | Unique address ID for an address belonging to a company. This value is auto-generated with the Add Company API. | Integer |

Delete Company Address Successful Response

{"deleteCompanyAddressResponse":{

"contextResponse":{"tenantName":"CBD",

"statusCode":"SUCCESS",

"errors":null},

"companyAddressId":"7",

"companyId":"1413"}

}

Delete Company Address Error Response Error if an invalid address ID is submitted Response HTTP 1/1 200 OK

{

"deleteCompanyAddressResponse": {

"contextResponse": {

"tenantName": "channel_sdk",

"statusCode": "SERVICE",

"statusMessage": "No entity address found with id: 7653",

"errorArgs": null,

"errors": null

},

"companyAddressId": "0",

"companyId": "0"

}

}

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. | |

| companyAddressId | Unique address ID for an address generated for a company address | Integer |

| companyID | Unique Company ID. This value was auto-generated when the company was initially created. | Integer |

Get Company Users

This operation retrieves all the Company Users of a given Company, using the company's Entity ID. The list is organized by the person ID in ascending order.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/getCompanyUsers |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | GET_COMPANY_USERS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Get Company Users Request

{

"entityId":"1413"

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| entityId | yes | Entity ID or Company ID. The ID that was auto-generated when the company was initially created in Create Company API. If this value is unknown, the Get Company API can be executed to retrieve it. | Integer |

Get Company Users Response

{

"getCompanyUsersResponse": {

"contextResponse": {

"tenantName": "channel_sdk",

"statusCode": "SUCCESS",

"errors": null

},

"companyUsers": [

{

"id": "1394954216",

"entity_id": "40606",

"entity_name": "test company 1",

"firstname": "test",

"lastname": "company 1",

"timezone": "America/Chicago",

"timezone_offset": "-06:00",

"status": "A",

"created_date": "2015-07-30T09:12:26.067-05:00"

},

{

"id": "1394954217",

"entity_id": "40606",

"entity_name": "test company 1",

"firstname": "test 2",

"lastname": "company 1",

"timezone": "America/Chicago",

"timezone_offset": "-06:00",

"status": "A",

"created_date": "2015-07-30T09:12:54.578-05:00"

},

{

"id": "1394954218",

"entity_id": "40606",

"entity_name": "test company 1",

"firstname": "test 3",

"lastname": "company 1",

"timezone": "America/Chicago",

"timezone_offset": "-06:00",

"status": "A",

"created_date": "2015-07-30T09:13:07.502-05:00"

}

]

}

}

Response Parameters

| name | Description | Value/Range |

|---|---|---|

| contextResponse | Contest Response | TenantName StatusCode - See status codes AdditionalStatusCode StatusMessage AdditionalStatusMessage ErrorArgs Errors |

| id | Person ID | Integer |

| entity_id | Unique ID generated for a company. | Integer |

| entity_name | Company Name. | Alphanumeric |

| firstname | First name of the Company User. | Alphanumeric |

| lastname | Last name of the Company User. | Alphanumeric |

| timezone | Person's timezone that was entered in the system. | |

| timezone_offset | Time Zones around the world are expressed as positive or negative offsets from UTC. | |

| status | This is the current status of the Company's account. One character is used for representing the following statuses: (A)CTIVE/ (S)USPENDED/(X) CLOSED | Alpha Character A/S/X |

| created_date | The date in which the Person information was added to the database. | Must comply with ISO8601 Date and Time format. Example: 2014-02-21 11:33:41.54408-05 |

Close Company

This operation closes a company and remove all users from the company. Closing a company changes the status flag from "ACTIVE" to "CLOSED" when completed and does not removed it from the database. This operation also has the option of closing all child companies and removing all their associated company users from the hierarchical tree.

Before the company is closed, a query is performed to verify all the companies' have a zero balance. If there is a balance, the company cannot be closed.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/closeCompany |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | CLOSE_COMPANY |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Close Company Request

{

"companyId":"40612",

"closeUsers":true,

"closeChildCompanies":true

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| companyId | yes | Unique Company ID company. This value is auto-generated in the Create Company API | Integer |

| closeUsers | yes no |

Yes, to remove all Company users from the company. | Boolean True/False |

| closeChildCompanies | yes no |

Yes, to close all child companies (entities) that are in the company's hierarchy. | Boolean True/False |

Close Company Response

{

"closeCompanyResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

},

"companyId": "40612"

}

}

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

| companyID | Unique Company ID. This value was auto-generated when the company was initially created. | Integer |

Get Government ID

This operation retrieves Government ID information. When the request is processed, only the data that was entered at creation is returned.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/getGovernmentId |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | GET_GOVERNMENT_ID |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Get Government ID Request

{

"governmentId":"2389"

}

Request Parameters

| Parameter Name | Required | Description | Value/Range |

|---|---|---|---|

| governmentId | yes | Unique ID number that was generated when the ID information was entered into the system. Note: This is not the idNumber. |

Integer |

Get Government ID Respond

{

"getGovernmentIdResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

},

"personId": "7013",

"idType": "SSN",

"idNumber": "22223C",

"issuePlace": "Austin",

"issueCountry": "FRA",

"issueDate": "2012-04-23",

"expirationDate": "2025-04-23"

}

}

Response Parameters

| Parameter Name | Required | Definition and Business Requirements | Value/Range |

|---|---|---|---|

| contextResponse | yes | Response context. | tenantName statusCode - See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

| personId | yes | This ID, is the person ID auto-generated when the person is created within the system. | Auto-generated ID returned from the server. |

| idType | yes | Type of ID issued from the Government. | MarticularConsular/Passport/AlienRegistration/VisaNumber/VoterID/DriversLicense/StateID/Other/TaxID/USMilitaryID/SSN/NationalID |

| idNumber | no | This is the official ID number from the Government ID. | Official ID returned from the server. |

| issuePlace | no | The city where the ID was issued. | Alpha characters |

| issueDate | no | This is the date in which the issue date information was added to the database. | This must comply with ISO8601 Date format Example: 2014-02-21 |

| expirationDate | no | This is the date in which the ID expiration information was added to the database. This must comply with ISO8601 Date format | This must comply with ISO8601 Date format Example: 2014-02-21 |

Update Government ID

This operation changes information about an existing Government ID.

* A Person can update their own Government ID.

* A Company User can update information for another Person. An example use case would be a Customer Service Person receiving a call

from a person, and acting on behalf of that Person.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/updateGovernmentId |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | UPDATE_GOVERNMENT_ID |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Update Government ID Request

{

"governmentId" : 2389,

"personId": 78133,

"idType" : "SSN",

"idNumber" : "22223C",

"issuePlace" : "Austin",

"issueCountry" : "FRA",

"issueDate" : "2012-04-23",

"expirationDate" : "2025-10-23"

}

Request Parameters

| Parameter Name | Required | Definition and Business Requirements | Value/Range |

|---|---|---|---|

| governmentId | yes | Unique Identifier that was generated with Create Government ID and is used as a reference in the system. | Auto-generated integer. |

| personId | no | Person ID auto-generated when the person is created within system | Auto-generated number created. |

| idType | no | Type of Government ID | Marticular Consular/Passport/Alien Registration/Visa Number/Voter ID/Drivers License/State ID/Other, TaxID/US Military ID/SSN, National ID |

| idNumber | yes | This is the official Government ID number. Usually displayed on the physical form. | Alphanumeric String. Example: 22223C |

| issuePlace | no | The city where the ID was issued. | Alpha character string. |

| issueCountry | no | This defines the country that the ID was issued. | Must be a 3 character alpha code. This must comply with ISO 3166-1. |

| issueDate | no | This is the date/time in which the issue date information was added to the database. | Must comply with ISO_8601 Date and Time format (YYYY-MM-DD). Example: 2014-02-21 |

| expirationDate | no | This is the date in which the ID expiration information was added to the database. | Must comply with ISO_8601 Date and Time format (YYYY-MM-DD). Example: 2022-02-21 |

Update Government ID Response

{"updateGovernmentIdResponse":{

"contextResponse":{

"tenantName":"CBD",

"statusCode":"SUCCESS",

"errors":null},

"personId":"7013","idType":"SSN",

"idNumber":"22223C","issuePlace":"Austin",

"issueCountry":"FRA",

"issueDate":"2012-04-23",

"expirationDate":"2025-10-23"} }

Response Parameters

| Parameter Name | Required | Definition and Business Requirements | Value/Range |

|---|---|---|---|

| contextResponse | yes | Response context. | tenantName statusCode See status codes additionalStatusCode statusMessage additionalStatusMessage errorArgs errors |

| personId | no | Returns the ID that is attached for this person. | Auto-generated number created. |

| idType | yes | Government ID | Marticular Consular/Passport/Alien Registration/Visa Number/Voter ID/Drivers License/State ID/Other, TaxID/US Military ID/SSN, National ID |

| idNumber | no | This is the ID number on the physical Government ID. | Alphanumeric String. Example: 22223C |

| issuePlace | no | The city where the ID was issued. | Alpha character string. |

| issueCountry | no | This defines the country that the ID was issued. This will comply with ISO 3166 | Must be a 3 character alpha code. This must comply with ISO 3166-1 standard. |

| issueDate | no | This is the date in which the issue date information was added to the database. | Example of the date format: 2014-02-21 |

| expirationDate | no | This is the date in which the ID expiration information was added to the database. | Example of the date format: 2018-02-21 |

Notifications

You can use Notifications to send a Short Message Service (SMS) notification to SMS-enabled mobile phones and to an email. These APIs give Tenants a single way to orchestrate notification delivery across SMS and email services. A process to make sure that the right notifications go out. Notifications are designed not to just send notifications, it employs tenant specific configurations to determine when and how notifications should be sent. Configurations are from tenant preferences – In addition, it enables merchants to segment their users. For example, to send messages to all customers or just to those that belong to a certain Person Type. Notifications are sent in the language supported by the Program and in according to preferences configured for each Tenant.

Set Preferred Notifications- describes how to set notification preferences.

Notifications Opt-Out - to discontinue or not receive Notifications.

Event Types

Notifications are triggered when certain Events occur. Using the Events design, you can define the events the system raises when you change certain data with applications or run certain processes. Tenants can also define the event handlers that react to these specific event instances. Raising an event is the act of creating an event instance. When an application raises an event, the platform checks if the affected user is configured to receive a notification or has opt-out of notifications for the type of event raised. If the user is configured to receive notifications for that type, the platform checks the user's language and Notification Method (SMS/Email) settings to determine which version of the message to send and how it will be sent.

Notification Methods

- SMS

Event Types

- ACTIVATE_ACCOUNT_NOTIFICATION

- Person account creation event that needs to be activated.

- ACTIVATE_PERSON_NOTIFICATION

- BASIC_NOTIFICATION

- CHANGE_PIN_PASSWORD_NOTIFICATION

- CREATE_ACCOUNT_NOTIFICATION

- Represents a notification sent when a subscribers account is created.

- TRANSFER_COMPLETED_NOTIFICATION

- Notification event implemented when a transfer has been TRANSFER_COMPLETED_NOTIFICATION

- WELCOME_PERSON_NOTIFICATION

Notification Types

- ACTIVATE_ACCOUNT

- ACTIVATE_PERSON_CREDENTIAL

- ADD_BALANCE_COMPLETED

- AIRTIME_COMPLETED

- AGENT_ASSISTED_PURCHASE_COMPLETED

- BILLPAY_COMPLETED

- CASH_IN_COMPLETED

- COMPANY_SVA_WITHDRAWAL_COMPLETED

- CREATE_ADDRESS

- CREATE_EMAIL

- CREATE_FIRST_EMAIL

- CREATE_FIRST_PHONE

- CREATE_PERSON

- CREDIT_AN_ACCOUNT_COMPLETED

- DEBIT_ACCOUNT_COMPLETED

- DELETE_ADDRESS

- DELETE_PHONE

- DEPOSIT_TO_COMPANY_SVA_COMPLETED

- DISTRIBUTE_STORE_VALUE_COMPLETED

- EARN_ITEMS_EVENT

- EARN_POINTS_EVENT

- ENCASH_MT_CODE_AT_CORRESPONDENT_COMPLETED

- ENCASH_MT_CODE_COMPLETED

- LOAD_CARD_COMPLETED

- LOAD_SVA_FROM_CREDIT_CARD_COMPLETED

- MVAULT_BY_AGENT_COMPLETED

- MVAULT_BY_CORRESPONDENT_COMPLETED

- PERSON_TO_PERSON_TRANSFER_COMPLETED

- POSITIVE_ADJUSTMENT_TRANSFER_COMPLETED

- PURCHASE_COMPLETED

- REDEEM_LOYALTY_REWARD_COMPLETED

- REDEEM_OFFER_COMPLETED

- REDEEM_REWARDS_EVENT

- REFUND_SVA_TO_CREDIT_CARD_COMPLETED

- REMITTANCE_COMPLETED

- SENDMONEY2MTCODE_COMPLETED

- SEND_MONEY_TO_MT_CODE_AT_CORRESPONDENT_COMPLETED

- SEND_MONEY_TO_MTCODE_ATCORRESPONDENT_COMPLETED

- SEND_MONEY_TO_MT_CODE_COMPLETED

- SENDMONEY2MTCODE_COMPLETED

- TEMPORARY_PASSWORD_RESET

- TEMPORARY_PIN_RESET

- TRANSFER_COMPLETED

- TRANSFER_COMPLETED_NOTIFICATION

- REMIT_FAILURE_EMAIL

- REMIT_INPROGRESS_BANK (HOME SEND NOTIFICATIONS)

- REMIT_INPROGRESS_CASH

- REMIT_INPROGRESS_WALLET

- REMIT_SUCCESS_BANK

- REMIT_SUCCESS_CASH

- REMIT_SUCCESS_WALLET

- UPDATE_ADDRESS

- UPDATE_EMAIL

- UPDATE_PHONE

- VERIFY_EMAIL

- VERIFY_PHONE

- WELCOME_PERSONACTIVATE_ACCOUNT

Notification Templates

The data available in the event is used to create the content of the notification. The different parameters in the event determine the correct notification template.

Notifications Opt Out

This operation removes an event type or all event types from a user's preferred notifications.

- A Person can Opt-out of Notifications for themselves.

- A Company User can Opt-out of Notifications on behalf of other Persons. An example use case would be a Customer Service Person receiving a call from a Subscriber.

"Notifications" are any messages sent via SMS, Email, or Push and support the following: - Trigger events; these events are defined by a notification type. - Bulk messaging; or "Push" notifications. - Language supported by the Program. - Are configurable according to the person's preferences, referencing the event type to receive notification messages, or not receive

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/notificationsOptOut |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | NOTIFICATIONS_OPT_OUT |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Notifications Opt-out

{

"personId":"7358",

"notifications": [

{ "name": "TEMPORARY_PASSWORD_RESET", "active": false}

]

}

Request Parameters

| Parameter Name | Required | Description | Value/Range |

|---|---|---|---|

| personId | no | Unique ID associated with a person. | Integer |

| notifications:name | yes | The notification type name.. | Alpha Special characters "_" One or more of the following notification types can be selected: - "TEMPORARY_PASSWORD_RESET" - "TEMPORARY_PIN_RESET" - "WELCOME_PERSON" - "ACTIVATE_ACCOUNT" - "REDEEM_REWARDS_EVENT" - "EARN_POINTS_EVENT" - "ACTIVATE_PERSON_CREDENTIAL" - "EARN_ITEMS_EVENT" - "CREATE_FIRST_EMAIL" - "CREATE_EMAIL" - "CREATE_PHONE" - "CREATE_FIRST_PHONE" - "UPDATE_PHONE" - "DELETE_PHONE" - "CREATE_ADDRESS" - "UPDATE_ADDRESS" - "DELETE_ADDRESS" - "VERIFY_PHONE" - "VERIFY_EMAIL" - "SENDMONEY2MTCODE_COMPLETED" - "UPDATE_EMAIL" - "REMIT_SUCCESS_WALLET" - "REMIT_SUCCESS_BANK" - "REMIT_SUCCESS_CASH" - "REMIT_FAILURE_EMAIL" - "REMIT_INPROGRESS_WALLET" - "REMIT_INPROGRESS_BANK" - "REMIT_INPROGRESS_CASH" |

| notification:active | yes | Select false to opt out the notification, or not make active. Select true to re-enable, or make active. |

Boolean True/False |

Notifications Opt-Out Responses

{

"notificationsOptOutResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

},

"notifications": {

"name": "TEMPORARY_PASSWORD_RESET",

"active": "false"

}

}

}

}

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. | - tenantName - statusCode - See status codes - additionalStatusCode - statusMessage - additionalStatusMessage - errorArgs - errors |

| notifications:name | If "active" is false, there are no notifications. If "active" is true, notifications are sent. |

Boolean True/False |

Set Preferred Notifications

Use this operation to configure a user to receive a notification for specific event types. - A Person can set their own preferred delivery method. By NOT passing a person's ID, the caller is requesting their own information.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/setPreferedNotifications |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | SET_PREFERED_NOTIFICATIONS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Set Preferred Notifications Request

{

"personId": 1394952276,

"notificationType":"TEMPORARY_PASSWORD_RESET",

"defaultNotification":"yes",

"preferedNotifications": [

{

"priority":"1",

"notificationMethod":"EMAIL"

},

{

"priority":"2",

"notificationMethod":"SMS"

}

]

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| notifications:name | yes | The type of notification the person will receive. There is a type for each API that triggers a notification. Each type must be declared. | String One or more of the following notification types can be selected: - "TEMPORARY_PASSWORD_RESET" - "TEMPORARY_PIN_RESET" - "WELCOME_PERSON" - "ACTIVATE_ACCOUNT" - "REDEEM_REWARDS_EVENT" - "EARN_POINTS_EVENT" - "ACTIVATE_PERSON_CREDENTIAL" - "EARN_ITEMS_EVENT" - "CREATE_FIRST_EMAIL" - "CREATE_EMAIL" - "CREATE_PHONE" - "CREATE_FIRST_PHONE" - "UPDATE_PHONE" - "DELETE_PHONE" - "CREATE_ADDRESS" - "UPDATE_ADDRESS" - "DELETE_ADDRESS" - "VERIFY_PHONE" - "VERIFY_EMAIL" - "SENDMONEY2MTCODE_COMPLETED" - "UPDATE_EMAIL" - "REMIT_SUCCESS_WALLET" - "REMIT_SUCCESS_BANK" - "REMIT_SUCCESS_CASH" - "REMIT_FAILURE_EMAIL" - "REMIT_INPROGRESS_WALLET" - "REMIT_INPROGRESS_BANK" - "REMIT_INPROGRESS_CASH" Case Sensitive |

| personId | no yes - If a company User is action on behalf of another Person. |

Person ID | Integer values only |

| defaultNotification | no | This will send the notification to the person's preferred delivery method. | - SMS - PUSH |

| priority | yes | Priority 1, Priority 2, etc. If Priority 1 is email and there is no email address, then selection 2 is chosen. In the example below, this is SMS). |

Integer values only - 1 - 2 - 3 |

| notificationMethod | yes | The available protocols used. | - SMS - PUSH |

Set Preferred Notifications Response

{

"setPreferedNotificationsResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

}

}

}

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context. | - tenantName - statusCode - See status codes - additionalStatusCode - statusMessage - additionalStatusMessage - errorArgs - errors |

Money Containers

Introduction

A Money Container is a wrapper that encapsulates the information of financial account components used for mobile accounts. Money containers are referenced for purchases, bills, and funds transfer. Money containers are also used to store loyalty points, earned coupons, and funds that are reserved for a program's SVA (Stored Value Account) that functions much like a gift card.

Once a money container is created, it is assigned a unique ID, which is stored on the server. Our APIs pass this money container ID to a third party connector. For information and a list of connectors see: Third Party Connectors.

Money Container Creation

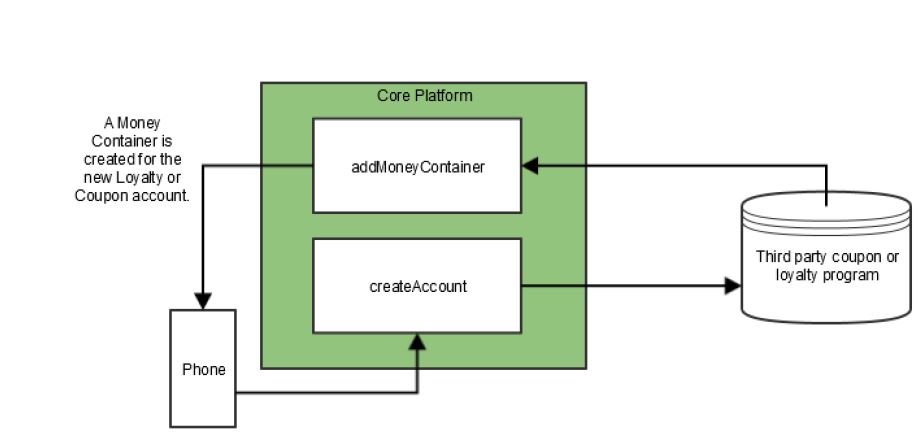

Create Account

The Create Account API allows users to create Loyalty and Coupon accounts on a third party, and Stored Value Accounts (SVA) on the core Switch for storing the values of these accounts. When the Create Account API is executed, an account is created on a third party system. Once the core Switch receives an acknowledgement that the account was successfully created on the third party system, the addmoneyContainer API is executed to generate a new Money Container ID for a user. Coupons, Loyalty Points, and Stored Value Accounts (SVA) are product specific, and do not exist outside of the program. If the program ends for the user, these accounts no longer exist for the user.

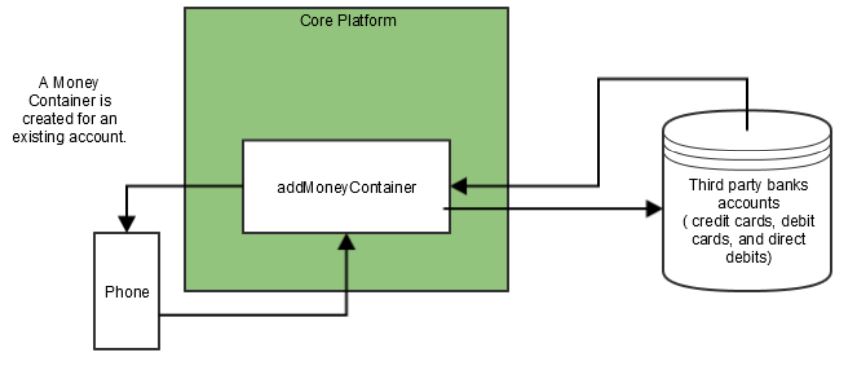

Add Money Container

The Add Money Container API is also used for creating a money container for a financial account that a user already owns such as a Credit, or Debit Card. Once the Money Container is loaded with funds after getting authorized. Bank Accounts can also have money containers attached, This includes merchant and personal accounts. These accounts are completely unaffected if a money container is removed, or added.

Container Types and their Subtypes

LiftCommerce can process transactions for Container Types and Sub-Types listed in the table below. This table includes all the the required parameters names, attributes, and secure attributes to complete transactions for each container sub-type. Attributes listed in the "Mandatory Attributes" column are required for a success transaction. "Optional Attributes" are stored on the core server for later use. For example, you may want to store the address of a loyalty point customer for birthday mailings. Items that are stored in the "Secure Attributes" hstore are both hashed and encrypted, and is in compliance with current security standards. Attributes that are not stored in the Secure Attribute hstore are stored in the Attribute hstore as non-secure data. All non-secure data is stored as plain text.

Money Container Fees and Limits

Meta data is information we collect for fees. Every transaction has it's own fee schedule. To track the fee used and applied to transactions, a unique name is assigned, and stored as a Meta Type.

Container Types and Sub-Types needed for the AddMoneyContainer API

| Container Types | Container Type Parameter Name | Container Sub-Type | Mandatory Attributes | Optional Attributes | Stored as Secure Attribute |

|---|---|---|---|---|---|

| Credit and Debit Cards | CC | VISA Mastercard American Express Discover |

Account_Name EXPIRE_YEAR EXPIRE_MONTH CREDIT_CARD_CVV |

-- HOLDER_FIRST_NAME HOLDER_LAST_NAME HOLDER_ADDRESS_LINE_1 HOLDER_ADDRESS_LINE_2 HOLDER_ADDRESS_CITY HOLDER_ADDRESS_STATE HOLDER_ADDRESS_POSTALCODE HOLDER_ADDRESS_COUNTRY ADDRESS_ALIAS |

Yes No No No No No No No No No No No No |

| Bank Accounts | BANK_ACCOUNT | CHECKING SAVINGS |

ROUTING_NUM ACCOUNT_NAME |

ADDRESS_ALIAS |

Yes Yes No |

| Stored Value Account | SVA | none | ACCOUNT_NAME | No |

Money Container Restrictions

Money Containers can perform three Operations - Debit, Credit and a Balance Look-up. Each of these operations are configured

for every money container type and its sub-type in the tenant configuration. The operations for each money container type are in the table below.

The default configuration for each operation is set to "TRUE", and cannot be overwritten within the configuration. To overwrite, the actual transaction code base must be modified.

| Money Container Type | Money Container Subtype | Available Options |

|---|---|---|

| CC | VISA MASTERCARD DISCOVER AMERICANEXPRESS |

"Debit Operations" "Balance Lookup Operations" |

| BANK_ACCOUNT | "Debit Operations" "Credit Operations" |

|

| SVA | none | "Debit Operations" "Credit Operations" "Balance Lookup Operations" |

If a Transaction attempts to perform an operation that is defined as restricted, the following errors are returned.

1. Error status code VALIDATION

2. Additional status code MC_OPERATION_NOT_ALLOWED

3. Additional status message: Operation type {type name} is not allowed for the money container of the type {money containertype and subtype}.

Transaction Steps

Each of the Operations are further divided into Transaction Steps, which are grouped under each operation.

| Operations | Transaction Steps |

|---|---|

| Debit Operations | HOLD COMMIT DEBIT REDEEM PURCHASE BANK_TRANSFER |

Deletion of Money containers

Money Containers cannot be completely removed from the system. For auditing purposes; we must keep account information for all

money containers should any suspicious activity occur. At this time we keep the last 4-digits of the account number as a reference.

When the Remove Money Container operation is processed on the platform, the money container is marked as deleted and the account ID which is stored is removed.

1. When a Remove Money Container transaction is processed on the platform:

2. The Money Container is marked as deleted.

Money Container Status

There are two statuses for Money Containers:

1. ACTIVE

2. DELETED

To track the possible statuses of a Money Container, see the phoenix.switch_moneycontainer table

| API | State | Description |

|---|---|---|

| removeMoneyContainer | DELETED ( Soft) | Account has been de-activated, and can no longer be referenced. It is not removed from the system. |

| addMoneyContainer | ACTIVE | An existing financial account is assigned to a new Money Container ID. |

| createAccount | ACTIVE | New Account is created with a new Money Container ID. |

| getMoneyContainer | Returns money containers that are in the "ACTIVE" state. | Returns all existing Money Containers. |

Add Money Container

This operation adds a Money Container for use when completing transactions. This API validates the fund source and stores the container's information for later use. A Money Container references an object on the core server that holds personal account information for a user that may include the source of of the funds or any other third party information.

To ensure credit card details are secure, customers must add their credit card information by using the provided attributes, and once a user authenticates into the system, any financial transactions they perform are encrypted, making the payment process safe and secure. Credit Card details can be separated into three distinct type of attributes:

attributesSecureRetrievable, attributes, and attributesSecure.

The two attributes that must be used if card details are needed in a response are attributesSecureRetrievable and attributes.

A description of all three attributes are described below:

- Fields sent within the attributesSecureRetrievable field are stored encrypted in the system and are returned decrypted.

- Fields sent within the attributes field are stored as clear text in the system and are returned in clear text.

- Fields sent within the attributesSecure field are stored encrypted in the system and are NOT returned in the response.

The Add Money Container API is executed in one of two ways:

From a Channel - A new money container is requested for an existing financial account, such as a Credit Card, Debit Card, or a Bank Account. For example; when a consumer has an already existing credit card account and requires a money container to pull and hold account information.

Executed from the backend - When the CreateAccount API creates a new account on a third-party system, and the core receives confirmation of account creation, the Add Money Container API is automatically executed and the Money Container ID returned in the response.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/addMoneyContainer |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| tenantName | {tenant_name} |

Add Money Container Request

{

"accountNumber": "4111111111111111",

"attributes": [

{

"key": "ACCOUNT_NAME",

"value": "My Credit Card"

},

{

"key": "MERCHANT_ID",

"value": "800000000264"

}

],

"attributesSecure": [

{

"key": "CREDIT_CARD_CVV",

"value": "123"

}

],

"attributesSecureRetrievable": [

{

"key": "EXPIRE_YEAR",

"value": "22"

},

{

"key": "EXPIRE_MONTH",

"value": "11"

},

{

"key": "CARD_HOLDER_FIRST_NAME",

"value": "Ashwin"

},

{

"key": "CARD_HOLDER_LAST_NAME",

"value": "Tandel"

}

],

"containerSubType": "VISA",

"containerType": "CC",

"contextRequest": {

"tenantName": "{ {tenant_name} }",

"token": "{ {subs_token} }"

},

"currency": "840",

"default": false,

"description": "Add during demo"

}

Request Parameters

| Parameter Name | Required | Data Type | Description | Example |

|---|---|---|---|---|

| ContextResponse | yes | Object Array | The response object |

Add Money Container Response

{

"addMoneyContainerResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

},

"id": "6121"

}

}

## Create Account

### Overview

This application creates a financial account on the third party system. A third party system may be either a coupon or a loyalty program provider.

When an account is initially requested, a new account is created in the third party. After the account is successfully created on the third party, a new Money Container is created in the Switch with a unique ID. This unique ID is used as the reference when accessing the money container.

[See *Money Containers*](http://www.google.com) for a full list of container types, sub-types, input parameters, attributes, and secure attributes for all money containers.

### Use Cases

- Company Users can create accounts for a company SVA, a Loyalty program, or an Offers program.

- Company Users can create accounts on behalf of a Subscriber.

- Company Users cannot create personal Money Containers, or use Money Containers for personal use.

- Subscribers can create accounts for their own SVAs, Offers and Loyalty programs.

<aside class="notice">

** Note:**

* The money container flag is set to `false` by default when it's initially created. <br> In order for a money container to be accessible, the value must be set to `true`.

</aside>

| | |

| :--- | :--- |

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/createAccount |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | CREATE_ACCOUNT |

| Required Authentication | Yes |

### Header Parameters

| Key | Value |

|--------------|-----------------------------|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization| Bearer {access_token} |

| tenantName | {tenantName}

> Create Account Request

> A subscriber creates a personal SVA.

```json

{

"personId":"1394952276",

"containerType":"SVA",

"isDefault":true,

"currency":"840",

"attributesSecure": [

{"key": "send_no_email", "value": "true"},

{"key": "first_name", "value": "Jane"},

{"key": "last_name", "value": "Doe"},

{"key": "ACCOUNT_NAME", "value": " Fancy Burgers Loyalty Program"}

]

}

Create Account Request A Company User creates a company SVA, only for company use.

{

"entityId":"307",

"containerType":"SVA",

"isDefault":true,

"currency":"840",

"attributesSecure": [

{"key": "send_no_email", "value": "true"},

{"key": "first_name_of_program_manager", "value": "Joe"},

{"key": "last_name_of_program_manager", "value": "Manager"},

{"key": "ACCOUNT_NAME", "value": "Store's SVA for their Loyalty Program"}

]

}

Request Parameters

| Name | Required | Description | Value |

|---|---|---|---|

| personId | no | A generated ID used to identify the use. | Auto-generated and sequenced incrementally. |

| entityId | no | The value must be entered if the user is a company related user. Subscribers are not associated with any company do not require this value. | Auto-generated and sequenced incrementally. |

| containerType | yes | This value is the parent of the container subTypes | See Money Containers for additional information. |

| containersubtype | no | Sub container type | See Money Containers for additional information |

| isDefault | yes | Designate if this money container will be used as the default money container. | Boolean true or false |

| attributes | yes | Key value pairs required by the third party. | Array of objects |

Attributes

| key | Value |

|---|---|

| send_no_email | true or false |

| first_name | string |

| last_name | string |

Response Parameters

| Name | Required | Description | Value |

|---|---|---|---|

| contextResponse | yes | Response returned | tenantName statusCode errors |

| id | yes | Money Container ID. | Integer |

Create Account Response when a subscriber creates a personal SVA.

{"createAccountResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

},

"id": "5890"

}

}

Create Account Response for a Company User who creates a company SVA.

{

"createAccountResponse": {

"contextResponse": {

"tenantName": "CBD",

"statusCode": "SUCCESS",

"errors": null

},

"id": "6141"

}

}

Error Responses Condition: If any of the parameters are invalid. HTTP Status Code:

4XX BAD REQUESTExample:

{

"currency": [

"Please provide a valid currency code.",

]

}

Get Money Container

This JSON operation retrieves a listing of all existing Money Containers that belong to a Person or a Company. This API will only return Money Containers in the "ACTIVE" state and not Money Containers that are marked as "DELETED".

- A Subscriber can retrieve a list of their own personal Money Containers, but are unable to retrieve other Subscriber's money containers.

- Only Company Users can retrieve a list of Money Containers that exist for another Person. An example use case would be a Customer Service Representative receiving a call from a Subscriber, and acting on behalf that Subscriber.

- Company Users can retrieve a list of Money Containers that exist for their Company.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/getMoneyContainers |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | GET_MONEY_CONTAINERS |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Get Money Container Request

{

"contextRequest": { },

"personId":"d34a9cb7-2a57-4b05-98fe-95c0e6665af9"

}

Request Parameters

| Name | Required | Description | Value/Range |

|---|---|---|---|

| personId | yes | ID of the Person in the platform. This was generated with the Create Person or Setup Account APIs. This value can be obtained using the Get Person API. |

This value is generated on the server for each Person. |

| entityID | no - if calling on a Person yes - if called |

Id of the Company in the Platform. Is generated in Create Company API. Required only if retrieving Money Containers for a Company. | This value is generated on the server for each Company. |

Get Money Container Response

{

"contextResponse": {

"tenantName": "CLOUDPAY",

"statusCode": "SUCCESS",

"errors": {}

},

"moneyContainers": [

{

"mozidoId": 4670,

"containerId": 4670,

"type": "CC",

"subType": "MASTERCARD",

"last4AccountDigits": "5454",

"description": "Test card",

"attributes": [

{

"key": "EXPIRE_YEAR",

"value": "20"

},

{

"key": "ACCOUNT_NAME",

"value": "My Credit Card"

},

{

"key": "Credit Card Number",

"value": "5454545454541234"

},

{

"key": "EXPIRE_MONTH",

"value": "10"

},

{

"key": "MERCHANT_ID",

"value": "800000000264"

}

]

},

{

"mozidoId": 4671,

"containerId": 4671,

"type": "CC",

"subType": "VISA",

"last4AccountDigits": "1111",

"description": "Test card",

"attributes": [

{

"key": "EXPIRE_YEAR",

"value": "20"

},

{

"key": "ACCOUNT_NAME",

"value": "My Credit Card"

},

{

"key": "Credit Card Number",

"value": "4111111111111234"

},

{

"key": "EXPIRE_MONTH",

"value": "10"

},

{

"key": "MERCHANT_ID",

"value": "800000000264"

}

]

},

{

"mozidoId": 4672,

"containerId": 4672,

"type": "SVA",

"last4AccountDigits": "3035",

"attributes": [

{

"key": "ACCOUNT_NAME",

"value": "Test account_IPP_user"

},

{

"key": "send_no_email",

"value": "true"

}

]

},

{

"mozidoId": 4674,

"containerId": 4674,

"type": "CC",

"subType": "VISA",

"last4AccountDigits": "8700",

"description": "Test card",

"attributes": [

{

"key": "EXPIRE_YEAR",

"value": "20"

},

{

"key": "ACCOUNT_NAME",

"value": "My Credit Card"

},

{

"key": "EXPIRE_MONTH",

"value": "10"

},

{

"key": "MERCHANT_ID",

"value": "800000000264"

}

]

},

{

"mozidoId": 4675,

"containerId": 4675,

"type": "CC",

"subType": "VISA",

"last4AccountDigits": "8700",

"description": "Test card",

"attributes": [

{

"key": "EXPIRE_YEAR",

"value": "20"

},

{

"key": "ACCOUNT_NAME",

"value": "My Credit Card"

},

{

"key": "EXPIRE_MONTH",

"value": "10"

},

{

"key": "MERCHANT_ID",

"value": "800000000264"

}

]

}

]

}

Response Parameters

| Name | Description | Value/Range |

|---|---|---|

| contextResponse | Response context | ContextResponse type |

| containerType | Money Container Type. See Money Containers for a list of valid money containers. | See Money Containers for valid types. |

| subType | Money Container SubType. See Money Containers for a list of valid money containers. | See Money Containers for valid sub-types. |

| last4AccountDigits | The last four digits of the account number associated with the money container. E.g. Last 4-digits of the credit card number. | 4 digits |

| default | Indicates if the Money Container is setup as the default option for all payments. | true or false |

| attributes | Key–> Value pairs representing tenant specific information that is passed with the money container | See Attributes Table |

Attributes Table

| Key | Description |

|---|---|

| ACCOUNT_NAME | Name on the Card |

| EXPIRE_YEAR | Two digits representing the year the card expires. |

| EXPIRE_MONTH | Two digits representing the month the card expires. |

| EXTERNAL_ID | ID or card number of the external account. |

Update Money Containers

This JSON operation adds or changes a Money Container's default status or any of the attributes associated with their money container.

A Person can update their own Money Containers for all their accounts.

A Company User can update Money Containers for another Person. An example use case would be a Customer Service Representative receiving a call from a Subscriber, and acting on behalf that Subscriber.

A Company User updates Money Containers for a Company

NOTE:

If no Person ID is passed, the current user's money container is updated.

| Method | POST |

| Resource URL | {Switch_URL}/api/v1/services/updateMoneyContainer |

| Request Headers | application/json text/plain |

| Response Formats | application/json text/plain; charset=utf-8 |

| Entitlements | UPDATE_MONEY_CONTAINER |

| Required Authentication | Yes |

Header Parameters

| Key | Value |

|---|---|

| Content-Type | application/json |

| api-key | {api-key} |

| Authorization | Bearer {access_token} |

| tenantName | {tenantName} |

Update Money Container Request

{

"id":"243659",

"personId":"1394952276",

"isDefault":false,

"description":"This was updated",

"attributes": [

{"key": "ACCOUNT_NAME", "value": "Updated account name"}

],

"attributesSecure": [

{"key": "CREDIT_CARD_CVV", "value": "123"}

]}

Request Parameters

| Name | Required | Style | Description | Value/Range |

|---|---|---|---|---|

| contextRequest | yes | Calling context | ContextRequest type. Token parameter is required. | |

| id | no - if called for self yes - if called for another user yes, to remove all Company users from the company. |

TEMPLATE | The is the Money Container ID. If this value is unknown, you may retrieve a list of money containers using the Get Money Container API | Auto-generated integer assigned tothe money container when it was initially created |

| personId | no - if called for self yes - if called for another user yes, to remove all Company users from the company. |

TEMPLATE | ID of the Person in the platform. This was generated with the Create Person or Setup Account APIs. This value can be obtained using the Get Person API. | This value is generated on the server for each Person. |

| entityId | no - if called for self yes - if called for another user yes, to remove all Company users from the company. |

TEMPLATE | ID of the Company in the Platform. This was generated in Create Company API. This value can be obtained using the Get Company API. Required only if retrieving Money Containers for a Company. |

This value is generated on the server for each Company. |

| isDefault | no | TEMPLATE | You must indicate if this money container will be used as a default money container. If not set,the server will set this value to "false". If the value is set to "true" but there is a Money Container that a)belongs to this user |

true or false |

| description | TEMPLATE | Description of the change | Alphanumeric | |

| attributes | TEMPLATE | Key–> Values pairs representing tenant specific information that is passed with the money container. A fixed key representing the name of attribute, followed by a value. See Money Containers for information on Attributes. |

Key = ACCOUNT_NAME value = Alphanumeric String |

|